tax planning

Showing all 6 results

-

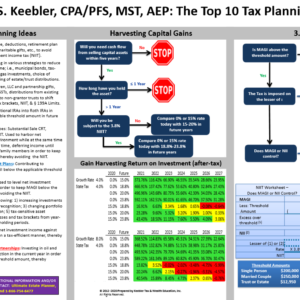

2024 Top 10 Tax Planning Ideas Chart

$32.00 Add to cart -

Estate Planning for Physicians Seminar Marketing Package

$1,495.00 Add to cart -

INSTANT DOWNLOAD: “Charitable Remainder Trusts: Misunderstood and Underused”

$199.00 Add to cart -

INSTANT DOWNLOAD: “Fundamentals of Income Taxation of Trusts: 2024 Update for 2023 Form 1041 Returns”

$199.00 Add to cart -

INSTANT DOWNLOAD: “How to Read a 1040 For Fun and Profit!”

$199.00 Add to cart -

The 2024 Robert Keebler Chart Bundle

$395.00 – $695.00 Select options This product has multiple variants. The options may be chosen on the product page