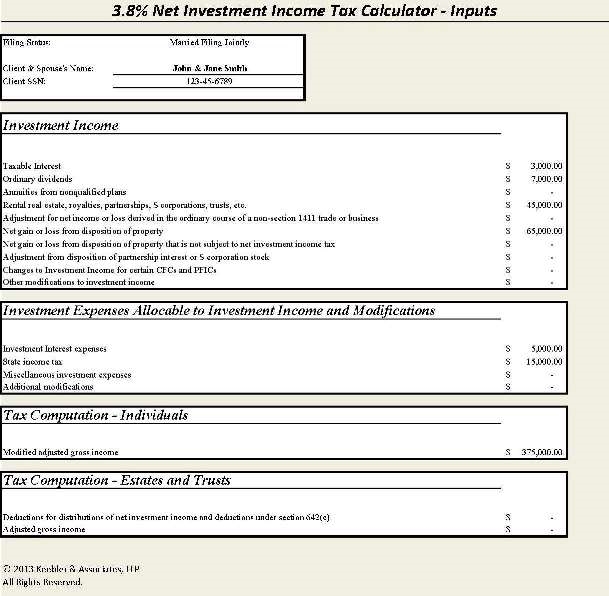

This is a unique calculator that allow you to input the necessary income and expenses for filling out the DRAFT versions of Form 8959 (the 0.9% Additional Medicare Tax Form) and Form 8960 (the 3.8% Net Investment Income Tax Form). These inputs are then transferred directly to the corresponding IRS Form and the tax calculations are done for you (NOTE: These Forms are NOT to be filed with the IRS). This NIIT Complete Calculator and Draft Form allows you to easily fill out the new IRS Forms. Additionally, it allows you to illustrate to your clients the substantial effect the NIIT may have on them. Once the effect of the NIIT on your client is known, proper tax planning can begin.

Product Details:

- Format: Microsoft Excel, Delivered Electronically

- Published: December 9, 2013

- Developers: Keebler & Associates, LLP