How Will You Stay on Top of the

Newest Developments as They Occur?

There have been changes in estate, tax, income, and retirement planning laws coming for a while now and it is more imperative than ever for estate planners to stay on top of these changes.

This is why we enlisted the help of nationally renowned CPA and tax planning expert, Robert S. Keebler, CPA/PFS, MST, AEP (Distinguished), CGMA. In the past, Bob put together a monthly teleconference, where he consolidated the latest important cases, rulings, and tax and estate planning changes, along with the planning strategies that result from these changes. But, we found that busy professionals like you couldn’t always attend the live calls or even find the time to listen to the recordings.

So, we’ve made it even simpler and more convenient for you!

In an effort to keep the estate planning community up-to-date and on top of all of these tax and planning changes, we are pleased to provide you…

The Robert Keebler Tax & Estate Planning

Monthly Bulletin

Bob and his team of experts at Keebler & Associates have agreed to put together a practical, “what you need to know” written bulletin, delivered to your e-mail inbox, for you to quickly review at your convenience.

Here are just a few of the benefits you’ll receive by signing up for this Monthly Bulletin:

- Up-to-date, summaries of the latest and pending tax changes

- Expert insight about how these changes can impact tax, financial, and estate planning for your clients

- Interim access to insider articles, briefings, podcasts and audio recordings when important and timely news hits between monthly editions

- Special promotions and offers on other of our Ultimate Estate Planner products and educational program

Why spend countless hours of your own time and energy to stay on top of all of the changes coming to the tax, financial, and estate planning world following the Tax Reform when you can have an expert do it for you?

Whether you’re an estate planning attorney, CPA, financial advisor or life insurance agent, you better be on top of it and be the first to advise your clients—or someone else will!

Click the “Details” tab for more information about available subscription options and to view a sample bulletin.

WHAT’S INCLUDED?

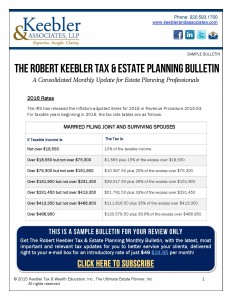

Each month, you will receive a Monthly Bulletin of anywhere from 5 to 8 pages (or more), chock full of important updates and invaluable content. There are some things you can’t get in audio format, such as charts and other diagrams.

This monthly bulletin will help you avoid having to sift through all of the different IRS rulings, court cases, tax law changes, etc. each month. You can now have Bob and his team consolidate this information and provide you with any pertinent planning strategies that you may be able to use for your clients.

REQUEST SAMPLE

Reviews

Leave a Review

cancel reply

CANCELLATION POLICY

Cancellations must be received prior to the following credit card charge. To cancel a subscription, the subscriber needs to send an e-mail to orders@ultimateestateplanner.com.

REFUND POLICY

Due to the nature of this product, no credits or refunds will be provided.

NOTE: The Ultimate Estate Planner, Inc. will do its best to accommodate any special requests from customers to assist with the successful delivery of the monthly updates. However, due to the various e-mail security settings of our customers, there may be delay or failure to receive e-mails from The Ultimate Estate Planner, Inc. in a timely fashion. It is not the responsibility of The Ultimate Estate Planner, Inc. to ensure receipt of e-mailed content. Failure to receive e-mails due to the customer’s e-mail security settings does not warrant a refund.

The field of estate planning is changing more rapidly now than I have seen in my 20 years in this industry. Bob Keebler’s monthly updates are an essential resource for my firm’s attorneys to keep current with the ever-changing landscape of our practice. We find that his information is clear and concise. Bob covers all the critical updates and highlights the implications to how we plan for our clients!

I love these bulletins! They give me a quick summary of everything that I need to know in an easy-to-read format that I’m able to share with everyone on my team. For a low monthly cost, the time and headaches this saves me having to go through multiple journals, e-mails, and CLE courses has been truly invaluable to my practice.